Stay Informed

Benetas newsroom features a collection of media releases, news, articles, and insightful opinions, all centered around the dynamic and evolving landscape of aged care.

Media Enquiries

Phone: 0400 224 852

Email: media@benetas.com.au

Our latest news

- Filter by category:

- Opinion

- Media Releases

- News Stories

- Support at Home

Category: Media Releases

Benetas is pleased to announce its purchase of The Oaks Retirement Community from Australian Unity, in Melbourne’s outer east.

Category: Media Releases

Benetas has developed a tool to help Victorians optimise how they use their Support at Home funding to receive the care they need.

Category: Media Releases

Bridgewater Lake resident and Bombers legend shows off classic car

Bridgewater Lake resident and Essendon Football Club icon Greg Sewell will display his copper blue 1957 President Classic Studebaker as part of the retirement estate’s famed Craft Market this weekend.

Category: Opinion

The New Aged Care Act took effect on 1 November 2025, bringing important changes to the way residential aged care fees and charges are set. Here’s what you need to know, whether you’re currently in care or considering it in the near future.

Category: Media Releases

Keyton welcomes Benetas residential aged care at Sherwin Rise

The sale of the aged care site at Keyton’s Sherwin Rise retirement village will see Benetas offer residents and the wider seniors’ community in Wollert access to residential aged care services, once the project is complete.

Category: Support at Home

Support at Home Factsheet

Get the answers to some frequently asked questions about the change from Home Care Packages to Support At Home.

Category: Media Releases

Kangaroo Flat great-grandmother celebrates 104th birthday

Benetas Kangaroo Flat resident Monica “Bonnie” Fitzpatrick marked her 104th birthday, celebrating more than a century of memories and loved ones.

Category: Media Releases

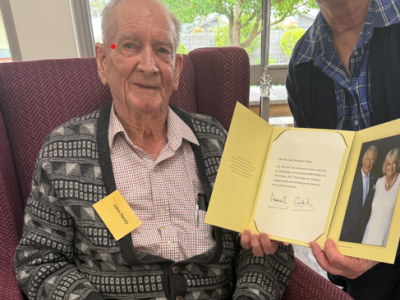

Benetas Dalkeith Gardens resident and Tyers community figure John Henry recently marked his 100th birthday, surrounded by friends, family and local dignitaries.

Category: News Stories

Big changes are coming to aged care – here’s what you need to know

From 1 November 2025, a new Aged Care Act will come into effect — and it’s set to improve the way older Australians are supported as they age.

Category: Media Releases

Mother and daughter artistic duo take part in record-breaking Bridgewater Lake Art Show

Benetas Bridgewater Lake resident Dorothy Collins and daughter Amanda Russell have bonded over their shared passion for painting over decades.

Category: Media Releases

Benetas is pleased to announce it is working closely with Moran Health Care Group to assume ownership and management of Moran Roxburgh Park.

Category: Support at Home

Support At Home News: Assistive Technology

modifications you need. From 1 November 2025, the new Support at Home program includes a special Assistive Technology and Home Modifications (AT-HM) scheme

Category: Media Releases

Benetas is pleased to announce the appointment of Paul Zanatta as the new Manager, Centre for Cultural Diversity in Ageing (The Centre).

Category: Media Releases

Filipino-born Pablo Soledad recently celebrated his 104th birthday surrounded by family and friends at Benetas St George’s aged care home in Altona Meadows.

Category: Opinion

It is essential for providers to share their experiences of running wellness and reablement programs, so all in the sector can learn from each other, writes Sandra Hills.

Category: Media Releases

Physio-focussed pilot improves balance and reduces chance of falls to help seniors stay at home

Benetas home care clients have experienced benefits following a Wellness and Reablement pilot, which included twice weekly physiotherapy sessions.

Category: Support at Home

Support at Home: Changes to Home Care Funding

Support at Home is replacing Home Care Packages. Discover what’s changing in funding, services, and contributions for older Australians.

Category: News Stories

Mother's Day celebrations across our care homes

Our residents from Gisborne Oaks, Colton Close and The Views Heidelberg had a fantastic time celebrating Mother's Day!

Category: News Stories

Retirement Living Bowls Challenge

Dalkeith Heights residents have taken home the second Benetas Retirement Living Bowls Challenge.

Category: Opinion

Navigating aged care changes won’t be easy, but we can’t lose sight of the bigger picture

For the past 16 years, I have proudly served as Benetas CEO, guiding processes that help residents, clients and employees through societal changes both relevant and irrelevant to the aged care sector.